China’s automobile export volume leads the way, shipping companies are well fed

February 19, 2024 Tina

Musk has said that without trade barriers, Chinese car brands would “kill” most of their rivals. The huge jump in China’s auto exports over the past year further proves his point.

Data show that China will export 4.91 million complete vehicles in 2023, a year-on-year increase of 57.9%. Among them, 1.203 million new energy vehicles were exported, a year-on-year increase of 77.6%.

Japan, once the largest country in automobile exports, also released corresponding data. According to data released by the country’s Automobile Industry Association on January 31, Japan’s automobile export volume in 2023 will be 4.42 million units, lower than China. This means that after surpassing South Korea and Germany, my country’s automobile exports have surpassed Japan to rank first in global automobile export volume.

While China’s automobile exports have experienced a blowout in a short period of time, the automobile shipping business has also shown new prosperity. According to data from shipping services group Clarksons, global long-distance ocean vehicle transport volume increased by 17% year-on-year in 2023.

One shipping company reaped an unexpected bonus. Norwegian shipping company Wallenius Wilhelmsen (hereinafter referred to as WW), the world’s largest automobile shipping company, set a profit record in 2023 as China’s growth in electric vehicle exports boosted shipping demand.

On February 14, WW stated that for the full year of 2023, the company achieved operating income of US$5.15 billion, a year-on-year increase of 2.1%; EBITDA was US$1.81 billion, a year-on-year increase of 16.7%; EBIT was US$1.22 billion, a year-on-year increase of 30.8%; Net Profit was US$970 million, a year-on-year increase of 21.8%.

WW CEO Lasse Kristoffersen said performance in the company’s core shipping services unit was largely driven by growth in China.

Of the 767 car carriers in the world, Oslo-based WW currently operates 125. Its main business is to transport cars made in Japan, South Korea and China to the European and North American markets. In addition to WW, the segment is dominated by Scandinavian company Höegh Autoliners and Japan’s NYK Line, MOL and K Line.

Chinese automakers have set their sights on the European and American markets. In the fourth quarter of 2023, China’s vehicle exports increased by 17.7% compared with the same period in 2022, and WW said that overall demand for seaborne vehicles increased by 11.8% in the quarter.

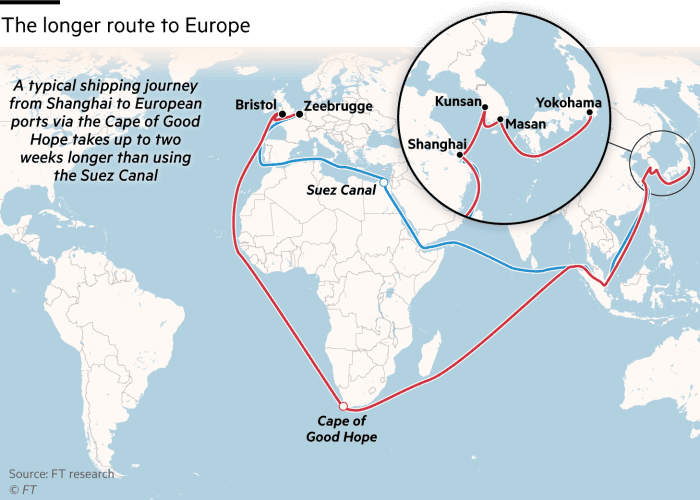

Although the Red Sea waterway crisis has caused uncertainty about the route through the Suez Canal, WW predicts that the company’s performance in 2024 will be slightly higher than in 2023.

Since November 2023, Yemen’s Houthi armed forces have attacked ships in the Red Sea, causing almost all car transport operators to avoid this route and instead go around the Cape of Good Hope. Starting in December 2023, WW will begin to divert ships to the Cape of Good Hope. The diversion added two weeks to the sailing time from Asia to Europe.

In the context of shipping companies rerouting around Africa, insufficient maritime transport capacity has become a new problem in international trade. Currently, the transportation of both complete vehicles and parts from Asia to Europe is hampered.

Affected by the Red Sea crisis, although freight rates increased, WW’s performance in the fourth quarter of 2023 declined both quarter-on-quarter and year-on-year due to reduced freight volume.

Before the Houthi attack, trade routes from Asia to Europe were already being squeezed by a lack of car carriers.

Stephen Gordon, general manager of research at Clarksons, said that under normal circumstances, about 25% of the world’s long-distance seaborne car ships pass through the Suez Canal. The company estimates that of all shipping sectors, the container shipping industry has suffered the greatest impact from the Red Sea problem.

However, the challenges faced by motor carriers are different from those faced by container shipping lines, as there was already a global glut of container ships before the crisis. Container lines are able to reactivate idle ships to meet the additional demand created by longer voyages. Affected by the epidemic, the market was in a downturn in 2020. During this period, car carriers scrapped a large number of cargo ships and will not purchase new ships until 2025.

Not only is the transportation of complete vehicles affected, since Asia still accounts for the majority of the global auto parts export market, the obstruction of the Red Sea waterway also affects the entire automotive supply chain. European automakers have already felt the impact, with companies including Tesla and Volvo saying they need to temporarily suspend production due to parts shortages.